Personal Finance

Investing made easy

OX publishes Personal Finance, Capital Market, and Investment articles on savings, credit, and value investing. The debt, equity, savings instruments, and various investment products are explained concisely by keeping retail investors in mind.

Retail investors are early to book profits and late to book losses, both behaviors reduce long-term investment returns.

— Progressive Value Investing, Maple Arbor

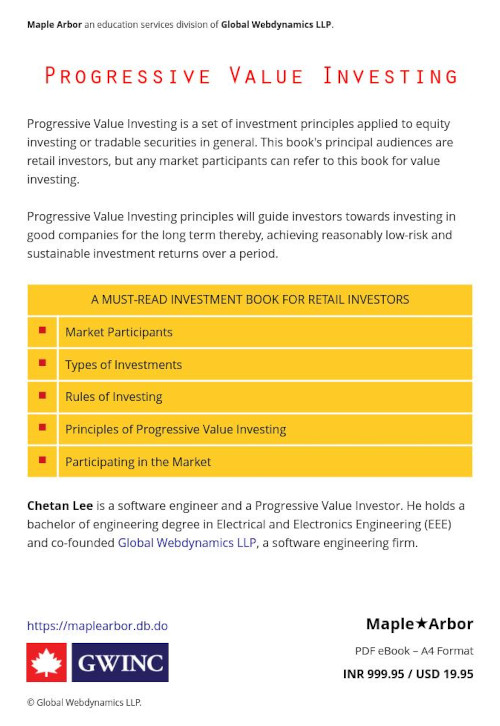

Progressive Value Investing, a retail investor guide to wealth creation, is our first book in the personal finance category. A must-read investment book for retail investors.

Progressive value investing

Progressive Value Investing stipulates the Four Golden Rules of Value Investing. Understanding these four rules is key to mastering long-term value investing. While investing in a good company, inventors should follow these four rules.

The Four Golden Rules of Value Investing:

- Learn to evaluate the company through products, services, and business models before considering share price valuation.

- Learn to focus on three to four good businesses you like and understand.

- Learn to be patient with investments in good businesses.

- Learn to value the significance of long-term compounding.

To know more about investing in the capital markets and Principles of Progressive Value Investing, Click here, Maple Arbor - Progressive Value Investing.

Progressive Value Investing is a set of investment principles applied to equity investing or tradable securities in general. Retail investors are the book's principal audience. However, all market participants can refer to learn more about value investing.

Progressive Value Investing advises investors to invest in equities, debt, or both. The investing principles advise against trading in equities and highly leveraged products like Futures and Options (F&O).

Progressive Value Investing principles will guide investors towards investing in good companies for the long term thereby achieving reasonably low-risk and sustainable investment returns.

List of chapters

- Market Participants

- Types of Investments

- Rules of Investing

- Principles of Progressive Value Investing

- Participating in the Market

Book details

GW-EDU-D1C4I1Capital gains tax in India

The Capital Gains Tax (CGT) is classified into the following two categories depending on the holding period of the tradable securities (stocks and bonds), Mutual Funds (MF), and Exchange Traded Funds (ETF).

- Short-term Capital Gains (STCG) Tax

- Long-term Capital Gains (LTCG) Tax

STCG

| Asset | Holding | CGT (FY25) |

|---|---|---|

| Stocks | < 1 Year | 15% |

| Equity MF/ETF | ||

| Bonds | < 3 Years | IT slab rate |

| Debt MF/ETF |

LTCG

| Asset | Holding | CGT (FY25) |

|---|---|---|

| Stocks | > 1 Year | Gains > 1 Lakh @ 10% |

| Equity MF/ETF | ||

| Bonds | > 3 Years | IT slab rate |

| Debt MF/ETF |

Dividend tax in India

The dividends from the domestic and foreign companies are reported under the income tax head Income from Other Sources and taxed at an investor's Income Tax (IT) slab rate.

The Tax Deducted at Source (TDS) is a withholding tax deducted on dividends if the dividend income is greater than the threshold limit.

Dividend tax

| Investor | Company | TAX |

|---|---|---|

| Resident | Domestic | IT slab rate |

| Foreign | IT slab rate | |

| Non-resident* | Domestic | 20% |

TDS on dividend

| Investor | Holding PAN | TDS |

|---|---|---|

| Resident | Yes | Dividend > 5K @ 10% |

| No | 20% | |

| Non-resident* | Yes | 20% |

*Non-resident investors can avail of the Double Taxation Avoidance Agreement (DTAA) if there is a DTAA between the non-resident country and India.

Foreign investors how to invest in India

For foreign investors, the easiest and most efficient way to invest in the Indian stock market is through India-based equity ETF (Exchange Traded Fund) offered by US Asset or Investment management companies or firms via US-registered stock brokerages.

We have partnered with Tastytrade, a US-registered stock broker-dealer company. Tastytrade is a member of FINRA, NFA, and SIPC.

For Indian investors wanting to invest in the US stock markets, Tastytrade offers a trusted investment platform and a competitive Zero-dollar ($0.00) Brokerage Fee to Buy and Sell US stocks and ETFs. Check out Tastytrade Pricing

Foreign investors, investing in Stocks and ETFs through Tastytrade, a US-registered stock brokerage don't have to pay any taxes on investment gains in the US.

The withholding tax deducted by the US brokerages on Dividends can be claimed as a Foreign Tax Credit by the foreign investor if there is a tax treaty to avoid double taxation between the US and the foreign investor's resident country.

Affiliate links

Setting up a Tastytrade US stock brokerage account to invest in Indian equity markets through ETF is easy and simple. Use our affiliate links to open a US stock brokerage account. The affiliate commissions we earn facilitate, Free website access for everyone.

The affiliate links are listed in alphabetical order without any favor. Users are encouraged to refer to the Global Webdynamics LLP Terms of Service governing the Third-party vendors.